The comprehensive analysis of cruise ship activity in Valencia, Spain, for the year 2024 offers a deep dive into the dynamics of the cruise industry and its implications for the city's tourism and local economy. Utilizing detailed schedules of cruise ship arrivals, the analysis covers various aspects, including the volume of traffic, the diversity of the cruise lines, and the seasonal patterns of visits. Through key figures, market share analysis, detailed breakdowns of cruise ship calls, and passenger trends, this study provides valuable insights into how Valencia serves as a cruise destination in the Mediterranean.

Key Figures

• Total Number of Individual Cruise Ships Expected: 78 different cruise ships are scheduled to arrive.

• Total Number of Cruise Ship Calls: There are 247 scheduled cruise ship calls throughout the year.

• Total Number of Cruise Passengers Expected: Assuming each ship arrives at full capacity, a total of 655,557 passengers are expected.

• Total Number of Cruise Lines: 32 different cruise lines have scheduled arrivals.

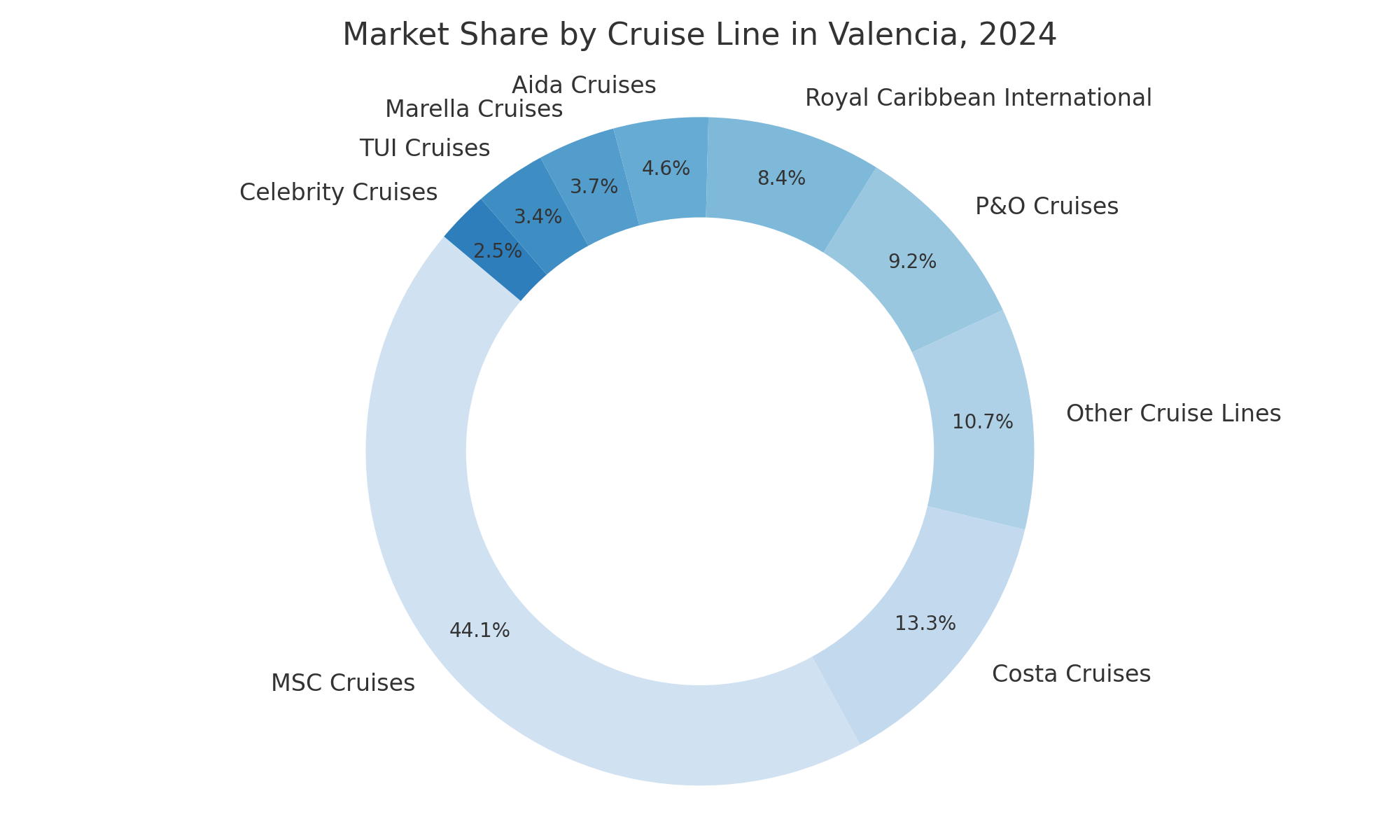

Market Share by Cruise Lines

• MSC Cruises dominates the market with a 44.1% share, operating 11 unique cruise ships and making 84 cruise ship calls.

• Costa Cruises follows with a 13.3% market share, 3 unique cruise ships, and 29 ship calls.

• Other cruise lines include P&O Cruises, Royal Caribbean International, Aida Cruises, Marella Cruises, TUI Cruises, and Celebrity Cruises, with market shares ranging from 2.5% to 9.2%.

| Cruise Lines Market Share in Valencia | ||||

| Cruise Line | Total Passengers | Unique Cruise Ships | Cruise Ship Calls | Market Share (%) |

| MSC Cruises | 288,864 | 11 | 84 | 44.10% |

| Costa Cruises | 87,090 | 3 | 29 | 13.30% |

| P&O Cruises | 60,332 | 5 | 13 | 9.20% |

| Royal Caribbean International | 55,336 | 7 | 15 | 8.40% |

| Aida Cruises | 29,996 | 3 | 14 | 4.60% |

| Marella Cruises | 24,574 | 3 | 13 | 3.70% |

| TUI Cruises | 22,610 | 3 | 9 | 3.40% |

| Celebrity Cruises | 16,516 | 3 | 6 | 2.50% |

Top 20 Cruise Ships Arriving in Valencia

This table reflects the ships that are expected to have the most significant impact on Valencia's cruise sector in 2024, based on their operational frequency and capacity. It highlights the diversity in ship sizes and the potential volume of tourists each can bring, underlining their importance to the local tourism economy and the logistical considerations for the port of Valencia.

| Top 20 cruise ships with most stops in Valencia | ||

| Cruise Ship | Number of Calls | Total Passengers |

| MSC Seaside | 29 | 119,886 |

| MSC Fantasia | 28 | 91,672 |

| Costa Pacifica | 24 | 72,336 |

| MSC Orchestra | 10 | 25,500 |

| AIDAstella | 9 | 19,746 |

| Marella Voyager | 9 | 17,208 |

| P&O Arvia | 8 | 41,648 |

| Voyager Of The Seas | 8 | 27,328 |

| Mein Schiff 2 | 6 | 15,036 |

| MSC Lirica | 6 | 11,904 |

| Azamara Quest | 5 | 3,610 |

| Costa Favolosa | 4 | 12,056 |

| Queen Victoria | 4 | 8,296 |

| AIDAdiva | 4 | 8,200 |

| Silver Moon | 4 | 2,304 |

| MSC Virtuosa | 3 | 14,430 |

| Celebrity Equinox | 3 | 8,550 |

| Marella Explorer 2 | 3 | 5,442 |

| Seven Seas Grandeur | 3 | 2,262 |

| Azamara Onward | 3 | 2,016 |

Cruise Passengers Per Month Expected in 2024

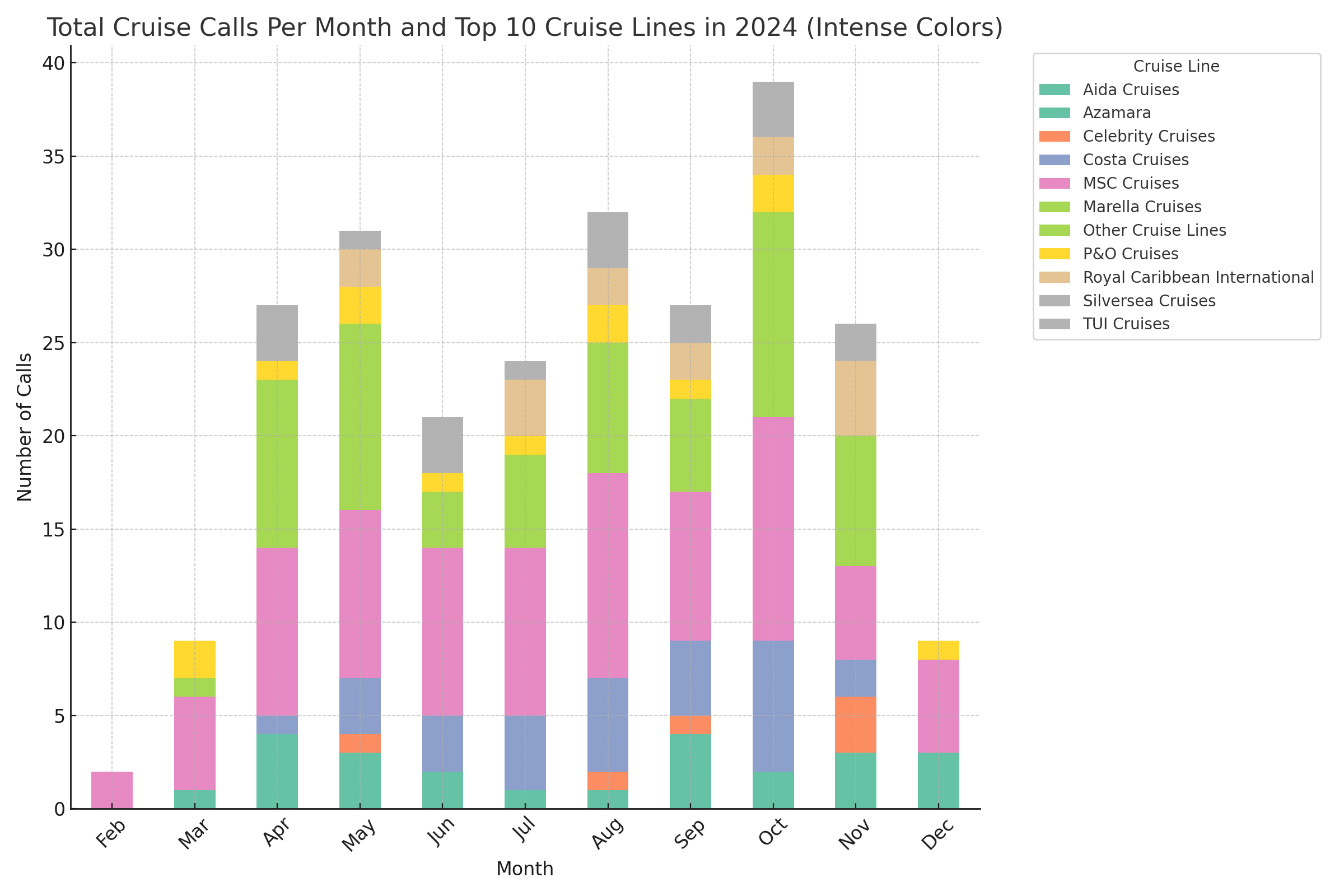

• The cruise traffic shows significant seasonality, with peaks in passenger volume during the spring and fall months.

• October sees the highest expected passenger volume, with 102,073 passengers.

• August also shows a high volume of cruise traffic, with 98,318 passengers expected.

• May, July, and September also show high passenger volumes, indicating consistent cruise activity during these months.

Total Cruise Calls per Month

Seasonal Variations: The chart clearly illustrates the cruise industry's seasonal variations, with visible peaks indicating busier months. This reflects the strategic scheduling by cruise lines to capitalize on favorable weather and travel demand patterns.